kansas dmv sales tax calculator

Its fairly simple to calculate provided you know your regions sales tax. Subtract these values if any from the sale.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004. Average Local State Sales Tax. Web Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Web To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. What you need to know about titling and tagging your vehicle. For additional information click on the links below.

Dealership employees are more in tune to tax rates than most government officials. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Web Vehicle Tax Costs.

Web While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. Maximum Local Sales Tax. Web Kansas Vehicle Property Tax Check - Estimates Only.

New car sales tax OR used car sales tax. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. Maximum Possible Sales Tax.

Web Title and Tag Fee is 1050. The sales tax rate for Shawnee was updated for the 2020 tax year this is the current sales tax rate we are using in the Shawnee Kansas Sales Tax Comparison Calculator for 202223. Web Tax and Tags Calculator.

Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. Sales and Use Tax. For more details on the age weight and size calculations for RV and motorhome property tax figures you can contact your local county treasurers office.

Maximum Local Sales Tax. Web Home Motor Vehicle Sales Tax Calculator. The county the vehicle is registered in.

There are also local taxes up to 1 which will vary depending on region. Revised guidelines issued October 1 2009. Just enter the five-digit zip code of the location in which.

The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Schools Special Hunting Opportunities. 30 plus 050 per 100 lbs.

You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. Remember to convert the sales tax percentage to decimal format. Kansas State Sales Tax.

24 flat rate there is no weight fee. Whether or not you have a trade-in. 50 plus 070 per 100 lbs.

For your property tax amount use our Motor Vehicle. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. Average Local State Sales Tax.

Web Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees. Web Shawnee County is the third largest county in the state of Kansas and is the home of the capital city Topeka.

Vehicle property tax is due annually. How Kansas Motor Vehicle Dealers and Leasing Companies Should Charge Sales Tax on Leases. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

11 years old or older. In this example multiply 38000 by 065 to get 2470 which makes the total purchase price. Web Burghart is a graduate of the University of Kansas.

Web 6 to 10 years old. Multiply the vehicle price after trade-ins andor incentives by the sales tax fee. Price of Car Sales Tax.

Web Kansas State Sales Tax. If you are unsure call any local car dealership and ask for the tax rate. The minimum is 65.

First Letter of Last Name. Learn more about Shawnee County in the Visitors CenterFind out about local attractions institutions and more. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

Once you have the tax. Vehicle tax or sales tax is based on the vehicles net purchase price. Department of Revenue guidelines are intended to help you become more familiar with Kansas.

Web Sales Tax Guidelines. You cannot register renew or title your vehicle s at the Treasurers office located in the. Multiply the net price of your vehicle by the sales tax percentage.

The state in which you live. Motor vehicle titling and registration. Maximum Possible Sales Tax.

1981 and newer models. You pay tax on the sale price of the unit less any trade-in or rebate. You can find these fees further down on the page.

Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by makemodelyear VIN or RV weightyear for a partial or full registration year. From July 1 2006 through June 30 2009 KSA. Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year.

Web How to Calculate Kansas Sales Tax on a Car. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. The type of license plates requested.

How Do State And Local Sales Taxes Work Tax Policy Center

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

What S The Car Sales Tax In Each State Find The Best Car Price

Kansas Sales Tax Guide And Calculator 2022 Taxjar

Dmv Fees By State Usa Manual Car Registration Calculator

Trade In Sales Tax Savings Calculator Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Missouri Car Sales Tax Calculator

Sales Tax On Cars And Vehicles In Kansas

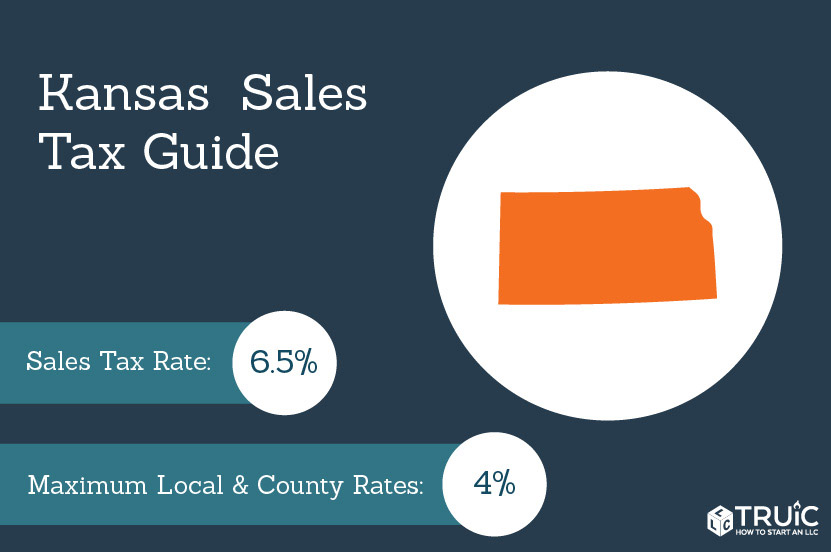

Kansas Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Kansas Vehicle Sales Tax Fees Find The Best Car Price

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

How To Calculate Sales Tax For Vermont Title Loophole Cartitles Com